Understanding Islamic Banking: Principles, Practices, and Perspectives

Islamic banking has emerged as a distinct and rapidly growing sector within the global financial industry, offering an alternative model that adheres to Islamic principles and Sharia law. With a focus on ethical finance, risk-sharing, and social responsibility, Islamic banking provides a unique approach to financial intermediation that resonates with Muslim communities worldwide. This article aims to explore the principles, practices, and perspectives of Islamic banking, highlighting both its positive contributions and potential challenges, supported by relevant references.

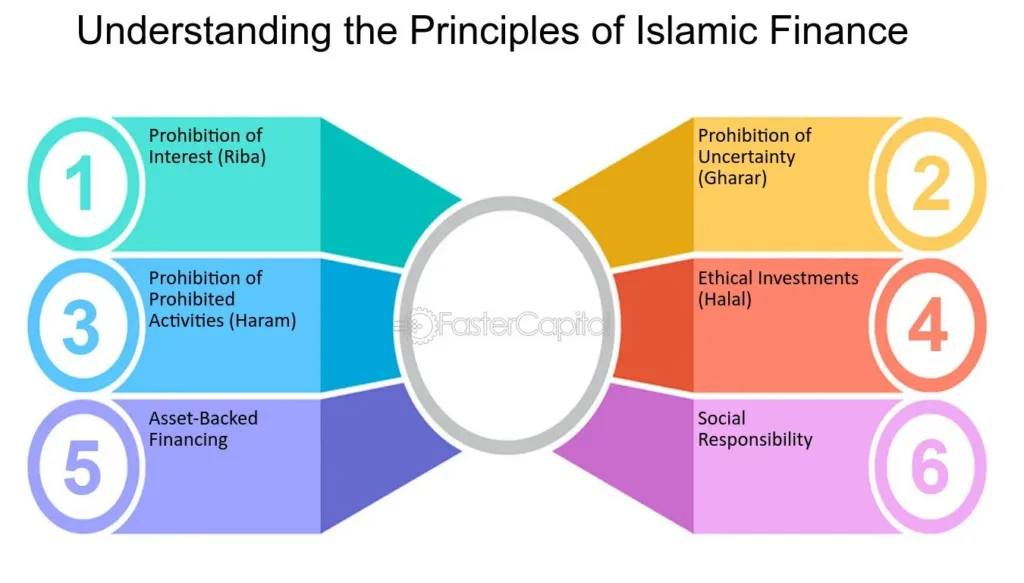

Principles of Islamic Banking:

- Sharia Compliance: At the heart of Islamic banking is adherence to Sharia principles, which prohibit interest (riba), uncertainty (gharar), gambling (maysir), and unethical investments. All financial products and transactions in Islamic banking must comply with Sharia law, ensuring ethical and halal practices. Reference: [Iqbal, Z., & Mirakhor, A. (2007). An Introduction to Islamic Finance: Theory and Practice.]

- Profit-and-Loss Sharing: Islamic banking operates on the principle of risk-sharing, where profits and losses are shared between the bank and its clients. This encourages a more equitable distribution of wealth and aligns the interests of both parties in the success of the investment. Reference: [Chapra, M. U. (1985). Towards a Just Monetary System.]

- Asset-Backed Financing: Islamic banking emphasizes the use of tangible assets in financial transactions, such as real estate, commodities, and businesses. This reduces speculation and ensures that investments are based on real economic activities, promoting stability and sustainability. Reference: [El-Gamal, M. A. (2006). Islamic Finance: Law, Economics, and Practice.]

- Ethical Investment: Islamic banks are required to screen investments to ensure they comply with Sharia principles, avoiding industries such as alcohol, gambling, tobacco, and weapons. This promotes socially responsible investing and contributes to the ethical development of society. Reference: [Obaidullah, M., & Khan, T. (2008). Islamic Microfinance Development: Challenges and Initiatives.]

Positive Aspects of Islamic Banking:

- Financial Inclusion: Islamic banking has played a significant role in promoting financial inclusion, particularly in Muslim-majority countries where conventional banking services may not be accessible or acceptable due to religious beliefs. Islamic banks offer a range of Sharia-compliant products and services tailored to the needs of diverse communities. Reference: [Archer, S., & Karim, R. A. A. (2007). Islamic Finance: The Regulatory Challenge.]

- Stability and Resilience: The principles of risk-sharing and asset-backed financing in Islamic banking have been credited with contributing to financial stability and resilience, particularly during times of economic crisis. Islamic banks have demonstrated lower exposure to speculative activities and toxic assets compared to their conventional counterparts. Reference: [Mirakhor, A., & Krichene, N. (2009). Recent Developments in Islamic Banking.]

Negative Aspects and Challenges:

- Hypocrisy and Non-Compliance: Despite the principles of Sharia compliance, some Islamic banks have been criticized for engaging in practices that contradict Islamic teachings, such as using loopholes to charge hidden fees or offering products that resemble conventional interest-based loans. This has led to accusations of hypocrisy and inconsistency within the industry. Reference: [Kettell, B. (2011). Introduction to Islamic Banking and Finance.]

- Lack of Standardization: The lack of standardization and harmonization in Sharia interpretation and implementation across different jurisdictions has been identified as a challenge for Islamic banking. This can lead to uncertainty and confusion among consumers and investors, hindering the growth and development of the industry. Reference: [Choudhury, M. A. (1997). Islamic Economics and Finance: A Bibliography.]

Conclusion: Islamic banking represents a unique approach to finance that integrates ethical principles, risk-sharing, and social responsibility into financial intermediation. While it has made significant strides in promoting financial inclusion, stability, and ethical investing, challenges such as hypocrisy and lack of standardization remain prevalent within the industry. Moving forward, greater efforts are needed to ensure genuine adherence to Sharia principles, enhance transparency and accountability, and promote harmonization and standardization across Islamic banking practices.

References:

- Iqbal, Z., & Mirakhor, A. (2007). An Introduction to Islamic Finance: Theory and Practice.

- Chapra, M. U. (1985). Towards a Just Monetary System.

- El-Gamal, M. A. (2006). Islamic Finance: Law, Economics, and Practice.

- Obaidullah, M., & Khan, T. (2008). Islamic Microfinance Development: Challenges and Initiatives.

- Archer, S., & Karim, R. A. A. (2007). Islamic Finance: The Regulatory Challenge.

- Mirakhor, A., & Krichene, N. (2009). Recent Developments in Islamic Banking.

- Kettell, B. (2011). Introduction to Islamic Banking and Finance.

- Choudhury, M. A. (1997). Islamic Economics and Finance: A Bibliography.

Responses